net investment income tax 2021 proposal

High-income taxpayers face a 38 net investment income tax NIIT thats imposed in addition to regular income tax. Fortunately there are some steps you may be able to take to reduce its impact.

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

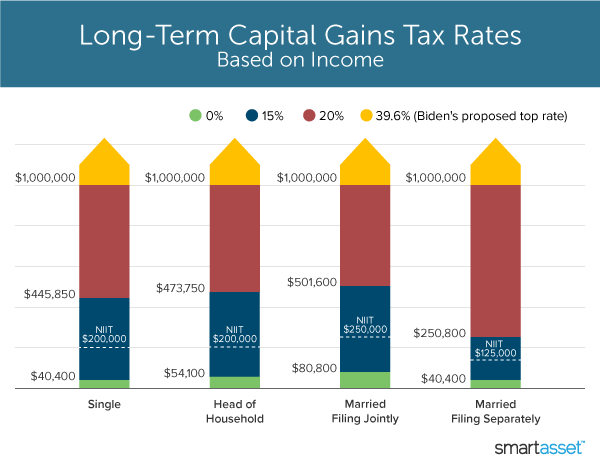

Increase in the maximum long-term capital gains rate The maximum capital gains rate would increase to 25 from the current rate of 20.

. New Income Tax Slabs Rates for FY 2021-22 AY 2022-23. Instead based on our reading of the latest proposal we are left with the following material changes to current tax laws. House Ways And Means Committee Advances 2021 Tax Change Proposals Hcvt Holthouse Carlin Van Trigt Llp Income Tax Law Changes What Advisors Need To Know.

The NIIT applies to you only if modified adjusted gross income MAGI exceeds. This rule change could have an impact on real estate professionals. Lawmakers Could Pay for Reconciliation While Improving the Tax Code October 25 2021.

The net investment income tax NIIT is a 38 tax on investment income such as capital gains dividends and rental property income. Those rates currently range from 10 to 37 depending on your taxable income. How Does it Impact the American Abroad.

The income level that this capital gains rate bracket applies to would be aligned with the new 396 rate bracket. The NIIT applies to you only if modified adjusted gross income MAGI exceeds. The NIIT applies to you only if modified adjusted gross income MAGI exceeds.

Below is a summary of the changes. By Gary Timpe. Thai Income Tax Bands 2021.

Fortunately there are some steps you may be able to take to reduce its impact. Plan ahead for the 38 Net Investment Income Tax 612021 Highincome taxpayers face a 38 net investment income tax NIIT thats imposed in addition to regular income tax. 250000 for married taxpayers filing jointly and.

The increase in the base capital gains tax rate from 20 to 25 is proposed to be effective for most gains recognized after September 13 2021 while the 3 surtax and expansion of the 38 net investment income tax would be effective beginning in 2022. Raising the top marginal tax rate on individual income to 396 percent and applying an 8 percent surtax on MAGI above 25 million. The adjusted gross income over the dollar amount at which the highest tax bracket begins for an estate or trust for the tax year.

However some profits namely those of S corporations arent subject to the 38 net investment income tax which was created by the Affordable Care Act to fund Medicare expansion. Fortunately there are some steps you may be able to take to reduce its impact. The proposal would increase this rate from 20 percent to 25 percent and effective for tax years beginning after December 31 2021 lower the income thresholds to which this top rate applies.

The increase in the base capital gains tax rate from 20 to 25 is proposed to be effective for most gains recognized after September 13 2021 while the 3 surtax and expansion of the 38 net investment income tax would be effective beginning in 2022. High-income taxpayers face a 38 net investment income tax NIIT thats imposed in addition to regular income tax. Fortunately there are some steps you may be able to take to reduce its impact.

38398 for Philadelphia residents. Capital gains recognized during the year would be included in determining the 1m threshold. The highest top tax rates on individual and corporate income in the developed world.

Expansion of the net investment income tax NIIT to cover net investment income from non-passive activities for taxpayers with greater than 400000 single or 500000 joint as well as for trusts and estates. The NIIT applies to you only if modified adjusted gross income MAGI exceeds. Lets review some basics.

Posted June 7 2021. For estates and trusts the 2021 threshold is 13050 Definition of Net Investment Income and Modified Adjusted Gross Income. In order to earn more tax dollars and to simplify the system beginning in tax years after 2021 President Bidens Greenbook proposes to subject all trade or business income of individuals earning over US400000 to either self-employment tax or NIIT.

This proposal would be effective for tax years beginning after Dec. PART II--Medicaid Provisions Sec. Jun 18 2021 By Dukhon Tax In Income Tax Individual Tax Tax Tips High-income taxpayers face a 38 net investment income tax NIIT thats imposed in addition to regular income tax.

April 2021 Learn how and when to remove this template message On 2 May 2018 the European Commission presented its proposal for 2021-2027 multiannual financial framework A modern budget. The new proposalsimposing an alternative minimum tax on corporate book income applying an excise tax on stock buybacks and at one point this week a tax on unrealized capital gains for billionairesare unreliable and highly complex ways to raise revenue. For individuals estates and trusts long-term capital gains and qualified dividends currently are subject to marginal income tax of 20 percent.

By Lea Uradu - Updated Dec 14 2021 at 1004AM Key Points The net investment income tax may be expanding. Considering that the Administration proposes to increase the top ordinary individual income tax rate to 396 434 including the NIIT the increase on capital gains and dividend income actually could be higher. The NIIT applies to you only if modified adjusted gross income MAGI exceeds.

Net Investment Income Tax NIIT on S Corp Profits If MAGI exceeds 500000 for a joint filer or 400000 for a single filer S Corporation profits will be subject to the 38 NIIT. Fortunately there are some steps you may be able to take to reduce its impact. What is Self-Employment Tax.

Income and Investments The top individual tax bracket remains 37 versus an increase to 396. Enacts a 5 surtax on modified adjusted gross income over 10000000 and an additional 3 surtax on modified adjusted gross income over 25000000 versus a 3 surtax on incomes above 5000000. A the undistributed net investment income or B the excess if any of.

The budget proposes several new tax increases on high-income individuals and businesses which combined with the BBBA would give the US. 24 of 7099 all earnings between 2751 9850 170376. An increase in the top individual tax rate from 37 to 396 for tax years ending after Dec.

June 14 2021. Plan ahead for the 38 Net Investment Income Tax July 21 2021 High-income taxpayers face a 38 net investment income tax NIIT thats imposed in addition to regular income tax.

House Democrats Propose Hiking Capital Gains Tax To 28 8

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

Seven Federal Tax Areas Businesses Should Be Focusing On During Year End Planning

House Democrats Tax On Corporate Income Third Highest In Oecd

What S In Biden S Capital Gains Tax Plan Smartasset

Like Kind Exchanges Of Real Property Journal Of Accountancy

Billionaires Income Tax Proposal Seeks To Ensure That U S Ultra Wealthy Pay Their Fair Share In Taxes Equitable Growth

Here S How Biden S Build Back Better Framework Would Tax The Rich

How Will Capital Gains Tax Increases In 2022 Impact M A This Year Clearridge

What Is The The Net Investment Income Tax Niit Forbes Advisor

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

Reconciliation Could Improve Medicare Solvency Committee For A Responsible Federal Budget

Taxing Wealth By Taxing Investment Income An Introduction To Mark To Market Taxation Equitable Growth

Proposed Legislation Includes Tax Increases Focused On High Income Individuals And Corporations Koley Jessen

The Billionaires Income Tax Is The Latest Proposal To Reform How We Tax Capital Gains Itep

Billionaires Income Tax Proposal Seeks To Ensure That U S Ultra Wealthy Pay Their Fair Share In Taxes Equitable Growth

Summary Of Fy 2022 Tax Proposals By The Biden Administration